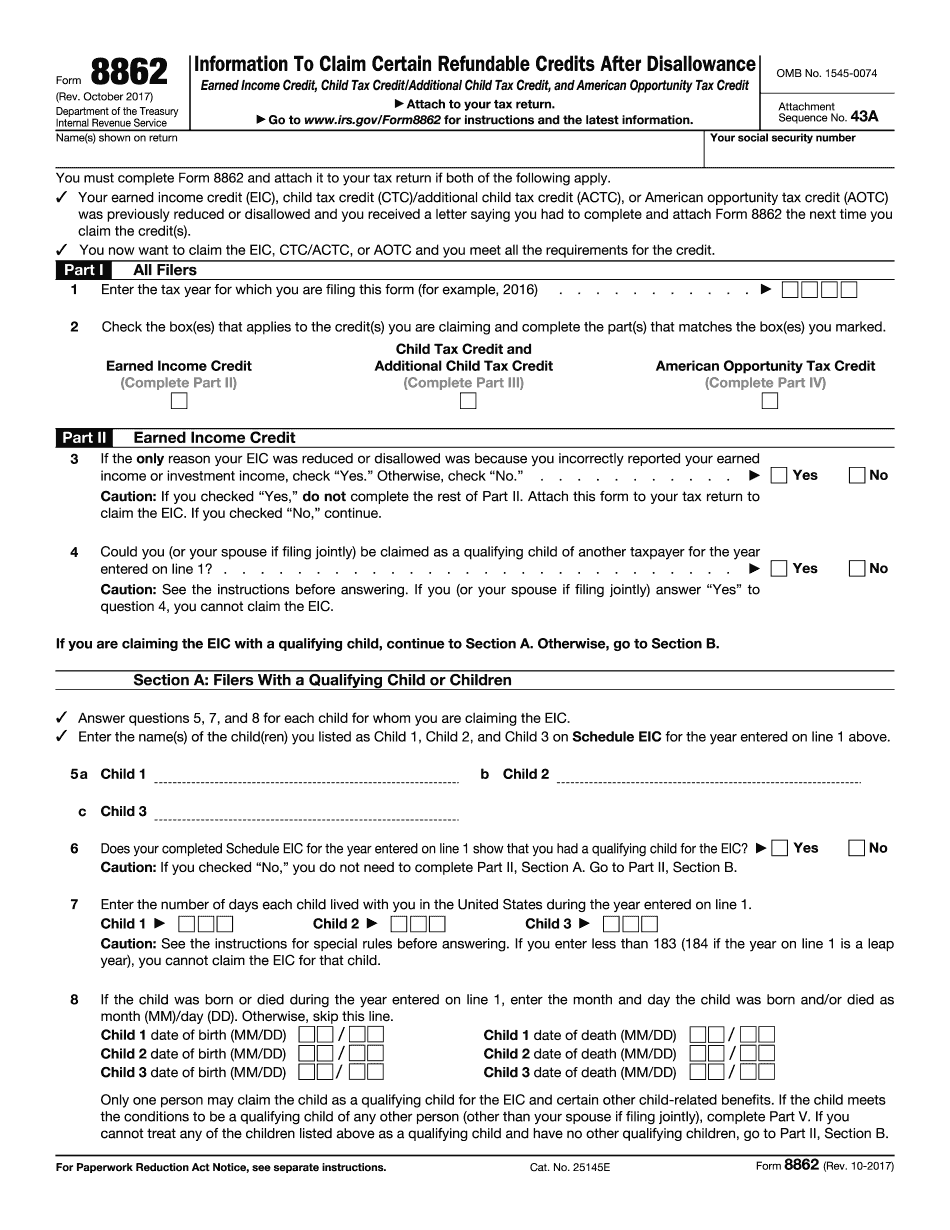

Hi I'm Rex for attacks comm errors on your tax return happen, and generally they delay your refund when the mistake is made while claiming the Earned Income Tax Credit. You can expect to wait a little longer to receive that portion of your tax credit, even extending into months long delays in some cases. Errors on the ETC portion of your tax return could result in a denial of your entire credit, should the IRS deny your ATC claim. You'll suffer some repercussions including repayment of the ETC amount you've received plus interest, filing form 8862 information to claim earned income credit after disallowance prior to attempting to claim the ETC on another tax return, and if the mistake is deemed reckless or intentional by the IRS, you won't be able to claim the ETC for the following two years. If the IRS determines your tax return was filed fraudulently, you'll be banned from claiming the ETC for the next decade.

PDF editing your way

Complete or edit your IRS 8862 2017 Form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export IRS 8862 2017 Form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your IRS 8862 2017 Form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your IRS 8862 2017 Form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare IRS 8862 2024 Form

About IRS 8862 2024 Form

The IRS 8862 form, also known as the "Information to Claim Earned Income Credit After Disallowance," is a tax form used by individuals who previously had their Earned Income Credit (EIC) disallowed by the Internal Revenue Service (IRS). Anyone who claimed the EIC and had it disallowed in a prior year must complete Form 8862 along with their tax return for the subsequent year if they wish to claim the EIC again. It is a requirement to reestablish eligibility for the EIC after a disallowance, and the purpose of this form is to ensure that taxpayers who were previously denied the EIC do not falsely claim it again. Form 8862 asks for information related to the taxpayer, their dependents, and other relevant details necessary to prove eligibility for the EIC. By completing this form, individuals are declaring that they meet all the eligibility criteria and requirements set by the IRS to claim the EIC again. It is important to note that only individuals who had their EIC disallowed in a previous year need to file Form 8862. Other taxpayers who have not faced EIC disallowance do not need to complete this form.

Online alternatives help you to manage your report administration and increase the productiveness of one's workflow. Keep to the quick manual to complete IRS 8862 2024 IRS Form 8862, prevent problems and also adorn this promptly:

How to complete the IRS 8862 2024 IRS Form 8862 online: - On the site with the file, click Begin right now along with cross towards the publisher.

- Use your hints for you to submit established track record job areas.

- Add your personal info and make contact with info.

- Make certain you enter correct data as well as quantities inside correct career fields.

- Wisely look at the content with the form and also grammar along with punctuation.

- Refer to Support area when you have questions as well as deal with our own Support group.

- Put an electric trademark on your own IRS 8862 2024 IRS Form 8862 with the aid of Indicator Tool.

- When the proper execution is completed, press Accomplished.

- Distribute the prepared file by way of electronic mail or even fax, print it out or save on the device.

PDF writer lets you make adjustments for your IRS 8862 2024 IRS Form 8862 from any internet attached gadget, colorize it for you as outlined by the needs you have, sign this in an electronic format and also deliver differently.

What people say about us

Take full advantage of an expert form-filler

Video instructions and help with filling out and completing IRS 8862 2024 Form